14-Jul-2020

Muthoot FinCorp NCD bonds June 2020 – Invest 1 Lakh and get 1.6 Lakhs in 5 years – What about risks?

Liberalizing of pricing cap will encourage financial inclusion, earlier in difficult territories where the cost of operation is high or the risk is high, MFIs were reluctant to operate due to their inability to price loans as per their risks and costs. Now with the new proposed pricing regime, risk-based pricing can be followed, which will allow MFIs to explore some new territories and provide much-needed credit to unserved and underserved.

On the 14th of June 2021, the Reserve Bank of India released a consultative document on Regulations of Microfinance; these draft regulations are nothing less than a major reform for the Microfinance Industry. This is a very pragmatic and visionary document that liberalizes the regulations governing microfinance lending. The documents aim to harmonize regulation among all players in the microfinance industry and foster competition which will ultimately benefit the end borrowers.

One of the biggest reforms among many in the draft document is liberalizing the pricing regime for NBFC-MFI. Till Now NBFC-MFIs were required to maintain their lending rate as lower of the two formulae shown below:

Cost of funds plus a margin cap of 12 percent, if its loan portfolio does not exceed ₹100 crores; or 10 percent otherwise; or

2.75 times the average base rate of the five largest commercial banks.

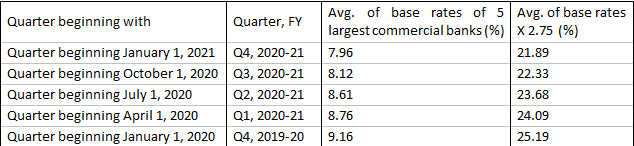

In a declining interest-rate scenario, these formulae create a very difficult situation for NBFC-MFIs, as for every 100 bps of base rate reduction, NBFC- MFIs have to reduce 275bps in their lending rate. Post the Covid-19 outbreak, RBI in its monetary policy has taken several initiatives to infuse liquidity, has cut policy rates to promote lending and boost economic activity. As a result, base rates of commercial banks have been reduced and the rates that MFIs can charge have also been reduced by 330 bps in just 5 quarters (table below)

Meanwhile, the operating costs of MFIs have marginally increased or remained the same, but credit cost has increased significantly. Due to collection-related challenges due to the pandemic, there is also a greater strain on operational costs; high digital adoption by customers is still quite far away. This is, in turn, creating severe pressure on the margins of NBFC-MFIs, especially the smaller ones who are not able to borrow money at cheaper rates.

The concept of margin caps was introduced in 2010-11, idea came from the Malegam Committee recommendation. In wake of the AP Microfinance crisis in 2010, RBI constituted a committee under the chairmanship of Shri Y H Malegamto study the issues and concerns in the MFI sector. Among many other recommendations, the study had recommended a rate cap of 26% and a margin cap of 12%, which later evolved into a 10% margin cap for MFIs with more than Rs. 100cr AUM; and a formula linked to the base rates of the top 5 commercial banks.

These regulations served the purpose in those times when there was a lot of ambiguity and speculation about MFI interest rates because there was a lack of availability of data. But since the turn of the decade Microfinance industry has matured a lot,8 MFIs have become SFBs, one has become a full commercial bank, several of them are now listed on stock exchanges. Hence there is an ample amount of information and case studies available about MFIs in the public domain. There are full-fledged MFI credit bureau systems in place. There are very well-respected Industry-SROs namely MFIN and Sa-Dhan which are actively monitoring this space. This gives RBI enough confidence to consider liberalizing the pricing regime for the microfinance sector.

Besides, the pricing cap was prohibitive and discriminatory considering the regulatory arbitrage that currently exists between NBFC-MFIs as compared to Banks, SFBs, and Section-8 companies. While NBFC-MFIs which represent 30% of the market were subjected to this margin cap, institutions such as Banks, SFBs, Section-8 companies, and other NBFCs were free to charge interest rates as per their own pricing policies. By liberalizing this pricing cap, RBI would create a level playing field for all the operators in the Microfinance space. This will lead to healthy competition and customers will definitely get benefit out of this.

Liberalizing of pricing cap will also encourage financial inclusion, earlier in difficult territories where the cost of operation is high or the risk is high, MFIs were reluctant to operate due to their inability to price loans as per their risks and costs. Now with the new proposed pricing regime, risk-based pricing can be followed, which will allow MFIs to explore some new territories and provide much-needed credit to unserved and underserved. Universal risk-based pricing would also be good for the financial health of the MFI industry as a whole.

To summarize, this liberalized pricing cap policy as proposed by RBI is very bold, pragmatic, and a sensible move. It should be supported wholeheartedly by the industry.

How to Get a Small Business Loan in India Easily? Read More

Harshit Agrawal 2021-08-11